Can the London housing bubble survive underwater?

PDF Version

The Thames Barrier protects London and the Thames valley from tidal inundation. The North Sea has been held back by this mechanised King Cnut since the 1980's. Coming to the end of it's predicted lifespan, the future of this high tech sea defense now comes into question.

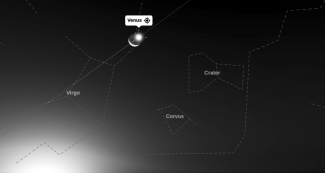

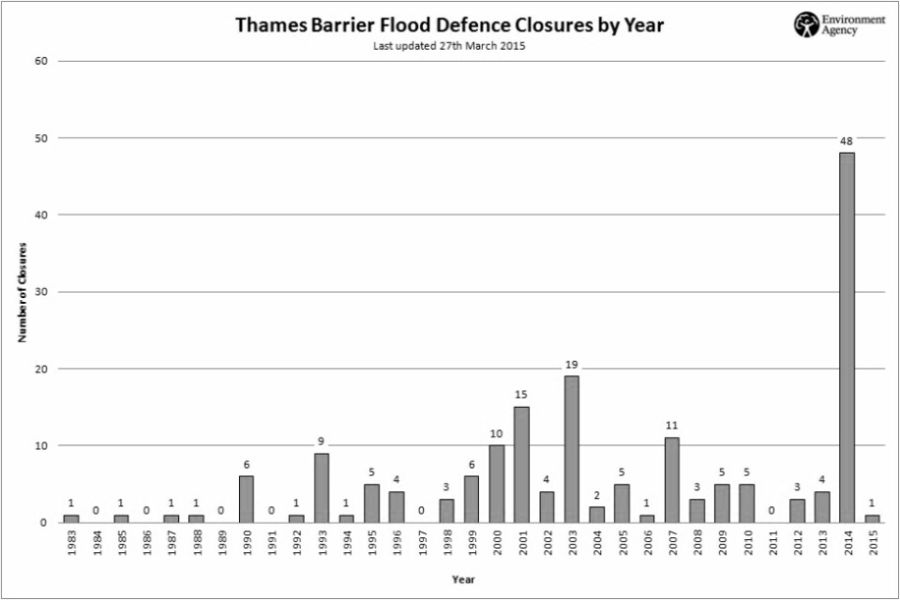

Any research available regarding the impending London flood risk generally includes an info-graphic or two. Most focus on the success of the Thames Barrier project. The Environment Agency asserts that everything will be fine until at least 2070. Many of the statistic graphs created for public consumption only represent data collected until 2015 where there seems to have been a sharp incline in the volume and frequency of tidal influx. Across the various articles on the subject, one specific theme recurs throughout; London is long overdue for some truly catastrophic flooding

The probability of major flood damage to a conurbation the size of Central London represents a few uneasy problems. As many house buyers across Britain have discovered, not checking whether your new home is located on a flood plain can cause some major issues when said plain inevitably floods. Not withstanding the more capable of DIY flood defense architects the average buyer is entirely dependent on insurance cover to 'bail them out' should the worst case possible scenario unfold. Many insurers will refuse to pay out based on a property being located on a known flood plain. What exactly prevents Central London from being classified as a flood plain is a bit on the vague side.

Interestingly enough, the artificial housing market in London provides a great many insurers with considerable amounts of business. From town house mortgage indemnity to contents insurance for garden sheds, the UK insurance market does very, very well out of Londoners desire for peace of mind. The housing market is so buoyant in London that it's become the norm for overseas investors to buy flats in London purely as an investment. Having no intention of ever moving to the UK or even using their property as a holiday apartment, these canny investors rightfully believe that they can sell their London property any time they please - for a profit.

The increased frequency of the Thames Barrier being deployed can only indicate an increasing risk of wide scale flooding. Therefore the willful refusal to accept the very real consequences of such a potential catastrophe must surely be based on some highly credible rationale. After all, Britain has considerable contingency apparatus courtesy of DEFRA and comprehensive COBR protocols ready to deploy. It couldn't possibly be merely a matter of revenue and housing market confidence... one hopes.

The potential damage to the London housing market can't be underestimated. Literally tens of thousands of domiciles and businesses would be destroyed. With the majority of the damage being in close proximity of the Thames, the financial value associated with the destruction of centrally located properties is substantial.

There are indicators in our current economic paradigm which point to a global shift away from office working. This raises the question of what exactly the city office buildings will be used for once everyone is an industrious telecommuter. The momentum behind the London property market does not imply that the city centre will be shutting down to save on electricity bills. The opposite is far more likely.

Gentrification has been a word on the lips of many London residents for decades. The average resident has experienced the revitalisation of several social hotspots. From the obligatory popup, authentic craftsmen in Shoreditch and Haggerston to the quixotic charms of post squat-party commercialism in Peckham. The formula is generally fairly predictable. Developers buy up old buildings from the council, dedicate 20% of the new builds to 'social housing' and spin off the rest as 'luxury' flats. Few concessions are made to outdoor space other than the odd roof terrace and the sprawl becomes just a bit more dense than it was before.

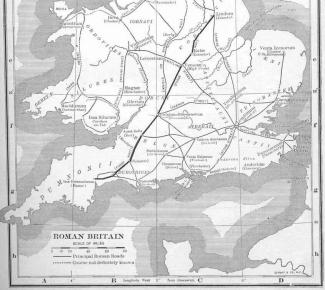

Various other areas of the capital have recently been earmarked for gentrification. The majority of these areas are outwith the proposed flood limits of a Thames barrier failure. The introduction of the rail upgrades for the 2012 olympics created commuter links between central London and numerous surrounding boroughs. In addition the completion of the Queen Elizabeth Line between Maidenhead and Abbey Wood has rapidly become a popular means of transporting volumes of commuters into central London. The rail corridor between Heathrow and Paddington is currently the location of major landworks with both residential and commercial developments under construction.

New housing developments and commercial premises attract house buyers and businesses into the capital. As soon as transport links facilitate a relatively painless method of ingress and egress, new developments sell out completely. This ongoing property speculation keeps the housing market in a constant state of growth, which in turn props up the housing bubble. In recent years the focus on riverside regeneration has subtly decreased in favour of the boroughs surrounding central London.

Due to the runaway success enjoyed by bookies over the past two decades, the government has compelled sports betting companies to reflect their growth in their physical portfolio. Consequently most high streets in most towns have bookmakers occupying at least one retail unit. As a direct result gentrification now equates to high streets with few shops, less pubs, several bookies and 'luxury' flats down both sides of the road. What were once vibrant and diverse communities are now cultural ghost towns where FaceBook, Netflix, Ebay, Pintrest, Instagram, SnapChat and WhatsApp have usurped conventional interaction. In some areas Amazon have even reached into the physical realm with their no employee franchises.

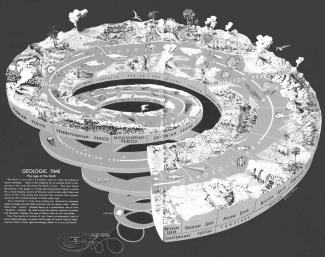

The alterations to the landscape of the capital as a result of catastrophic flooding can not be underestimated. The image above shows the impact of a failure of the Thames barrier and the resultant flooding. Based on the current elevation of the riverside topography, the increased river level would push both banks further into residential and business areas. This would also create hundreds of new 'Eyots' in the Thames from areas with higher elevation. The prospect of an extensive London archipelago might seem interesting from a real estate perspective. But with the vast amount of infrastructure decaying beneath the surface, any new islands would be subject to a variety of hazards.

The Thames barrier has thus far helped to prevent any catastrophic flooding events such as that of the 7th Jan 1928. In an unusually high tide 14 people drowned and thousands were left homeless after a major flood at Embankment. In the event of the barrier failing, there would undoubtedly be substantial damage to the mechanisms and installation. In order to prevent further influxes threatening the recovery effort, another barrier would need to be built. The existing barrier took ten years to complete and logically enough, any replacement would need to be substantial enough to protect against similarly high inundations.

Thames floods at Putney and Fullham are very common, as they are also at Maidenhead. The local communities have grown accustomed to this regular inundation and consequently there are few developments on the river front in these areas. Conversely, the banks of the Thames downriver have witnessed extensive development ever since the Romans rocked up with a bottle of fish oil and a penchant for Fly agaric. From Dartford to Chelsea, both banks have historically included commercial, industrial and residential premises.

Even if the Dept. for the Environment's estimation of 2070 is at all accurate (which many people seriously question) many properties have hundred year leases attached to them. Properties in the estimated flood area purchased in 2023 will (on average) come up for sale circa 2050. Even if they're new builds, it still means a serious question mark hangs over the integrity of their re-sale value. Nobody is going to pay hundreds of thousands of pounds for a property which is going to be flooded in twenty years.

The lack of publicity surrounding the increased usage of the Thames barrier appears to be deliberate. Far better for Londoners to be worrying about conflict overseas, ever present cultural frictions and the personal lives of reality TV contestants.